# load packages

library(tidyverse) # for data wrangling and visualization

library(tidymodels) # for modelingt

library(scales) # for pretty axis labels

library(knitr) # for pretty tables

library(patchwork) # for laying out plots

library(GGally) # for pairwise plots

# set default theme and larger font size for ggplot2

ggplot2::theme_set(ggplot2::theme_minimal(base_size = 20))Multiple linear regression (MLR)

Prof. Maria Tackett

Sep 21, 2022

Computational setup

Considering multiple variables

House prices in Levittown

- The data set contains the sales price and characteristics of 85 homes in Levittown, NY that sold between June 2010 and May 2011.

- Levittown was built right after WWII and was the first planned suburban community built using mass production techniques.

- The article “Levittown, the prototypical American suburb – a history of cities in 50 buildings, day 25” gives an overview of Levittown’s controversial history.

Analysis goals

We would like to use the characteristics of a house to understand variability in the sales price.

To do so, we will fit a multiple linear regression model.

Using our model, we can answers questions such as

- What is the relationship between the characteristics of a house in Levittown and its sale price?

- Given its characteristics, what is the expected sale price of a house in Levittown?

The data

# A tibble: 85 × 7

bedrooms bathrooms living_area lot_size year_built property_tax sale_price

<dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 4 1 1380 6000 1948 8360 350000

2 4 2 1761 7400 1951 5754 360000

3 4 2 1564 6000 1948 8982 350000

4 5 2 2904 9898 1949 11664 375000

5 5 2.5 1942 7788 1948 8120 370000

6 4 2 1830 6000 1948 8197 335000

7 4 1 1585 6000 1948 6223 295000

8 4 1 941 6800 1951 2448 250000

9 4 1.5 1481 6000 1948 9087 299990

10 3 2 1630 5998 1948 9430 375000

# … with 75 more rowsVariables

Predictors:

bedrooms: Number of bedroomsbathrooms: Number of bathroomsliving_area: Total living area of the house (in square feet)lot_size: Total area of the lot (in square feet)year_built: Year the house was builtproperty_tax: Annual property taxes (in USD)

Response: sale_price: Sales price (in USD)

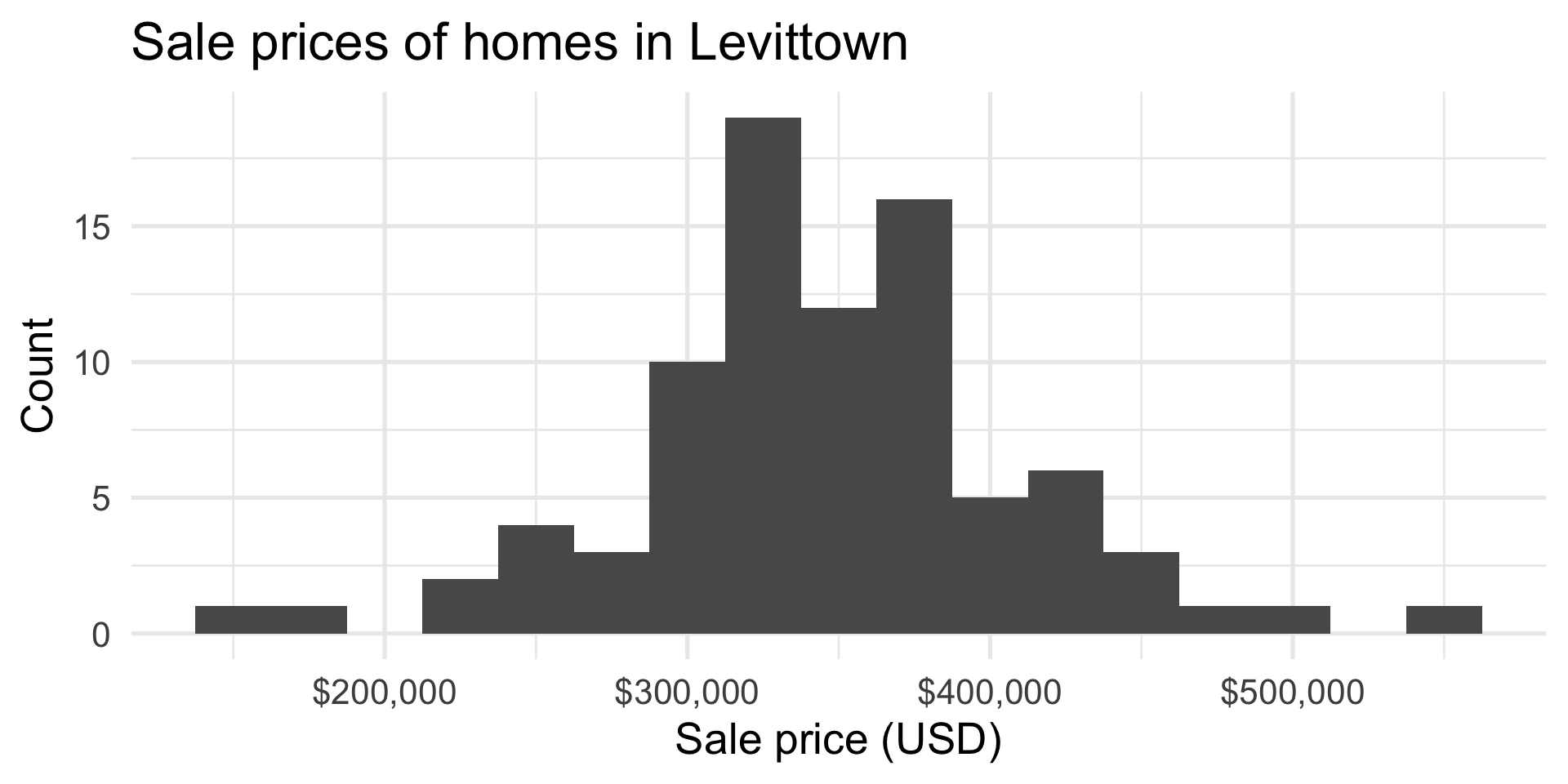

EDA: Response variable

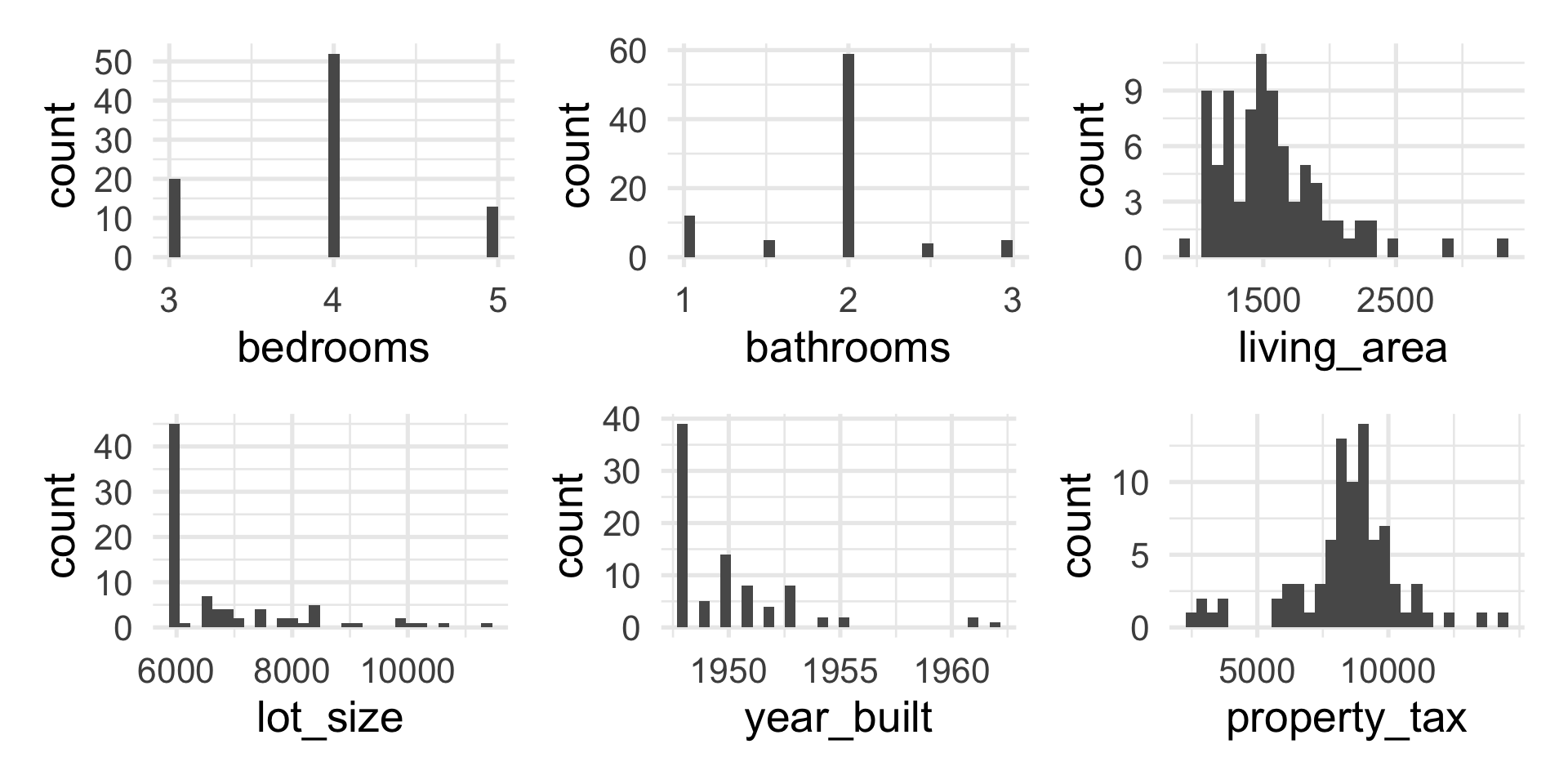

EDA: Predictor variables

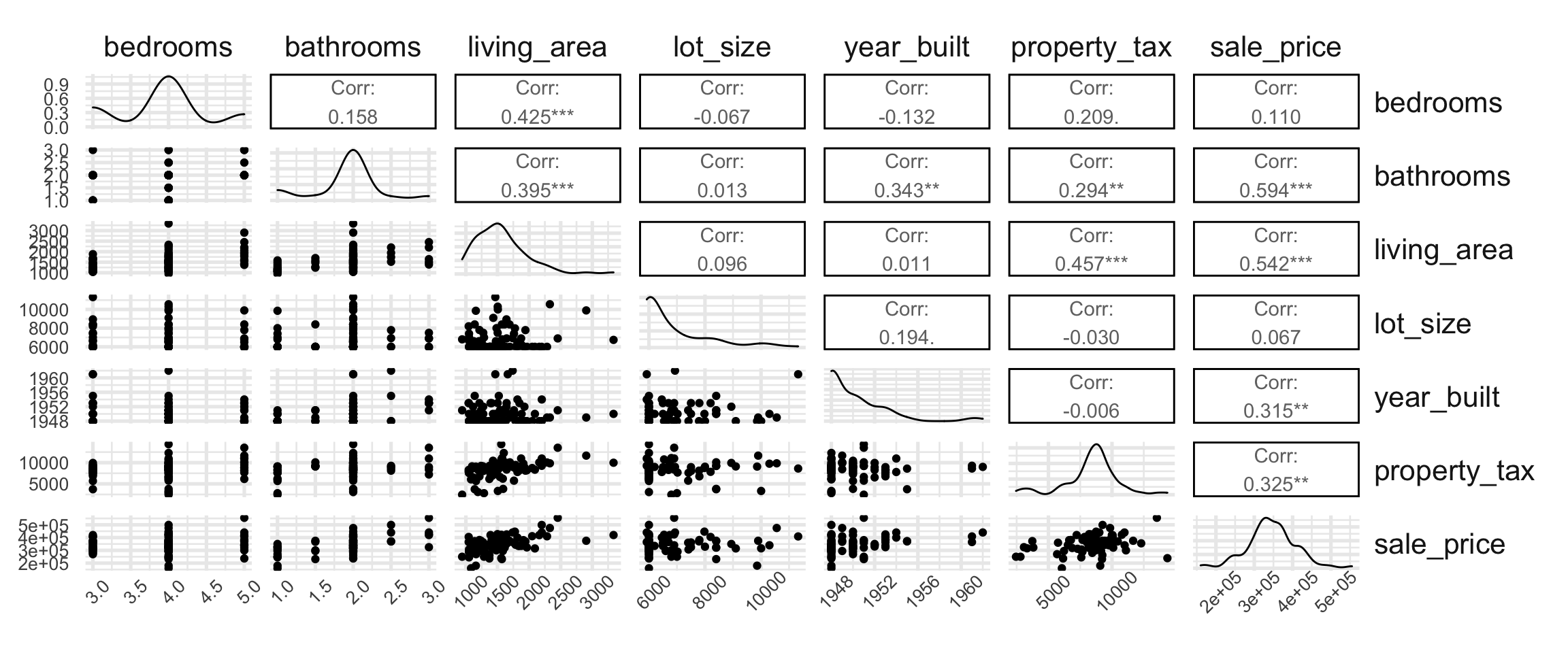

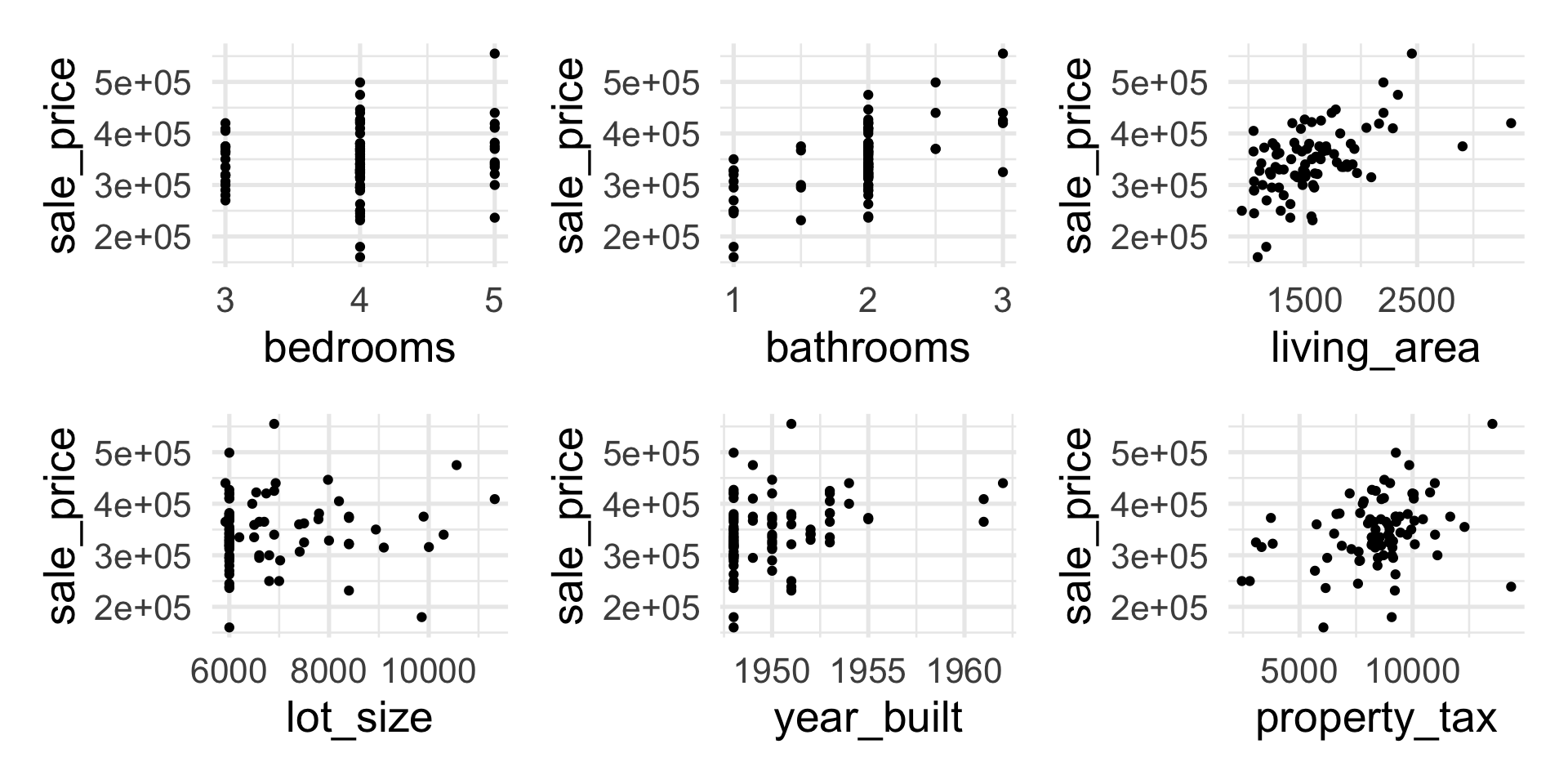

EDA: Response vs. Predictors

EDA: All variables

Single vs. multiple predictors

So far we’ve used a single predictor variable to understand variation in a quantitative response variable

Now we want to use multiple predictor variables to understand variation in a quantitative response variable

Multiple linear regression

Multiple linear regression (MLR)

Based on the analysis goals, we will use a multiple linear regression model of the following form

\[ \begin{aligned}\hat{\text{sale_price}} ~ = & ~ \hat{\beta}_0 + \hat{\beta}_1 \text{bedrooms} + \hat{\beta}_2 \text{bathrooms} + \hat{\beta}_3 \text{living_area} \\ &+ \hat{\beta}_4 \text{lot_size} + \hat{\beta}_5 \text{year_built} + \hat{\beta}_6 \text{property_tax}\end{aligned} \]

Similar to simple linear regression, this model assumes that at each combination of the predictor variables, the values sale_price follow a Normal distribution.

Regression Model

Recall: The simple linear regression model assumes

\[ Y|X\sim N(\beta_0 + \beta_1 X, \sigma_{\epsilon}^2) \]

Similarly: The multiple linear regression model assumes

\[ Y|X_1, X_2, \ldots, X_p \sim N(\beta_0 + \beta_1 X_1 + \beta_2 X_2 + \dots + \beta_p X_p, \sigma_{\epsilon}^2) \]

The MLR model

For a given observation \((x_{i1}, x_{i2} \ldots, x_{ip}, y_i)\)

\[ y_i = \beta_0 + \beta_1 x_{i1} + \beta_2 x_{i2} + \dots + \beta_p x_{ip} + \epsilon_{i} \hspace{8mm} \epsilon_i \sim N(0,\sigma_\epsilon^2) \]

Prediction

At any combination of the predictors, the mean value of the response \(Y\), is

\[ \mu_{Y|X_1, \ldots, X_p} = \beta_0 + \beta_1 X_{1} + \beta_2 X_2 + \dots + \beta_p X_p \]

Using multiple linear regression, we can estimate the mean response for any combination of predictors

\[ \hat{Y} = \hat{\beta}_0 + \hat{\beta}_1 X_{1} + \hat{\beta}_2 X_2 + \dots + \hat{\beta}_p X_{p} \]

Model fit

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | -7148818.957 | 3820093.694 | -1.871 | 0.065 |

| bedrooms | -12291.011 | 9346.727 | -1.315 | 0.192 |

| bathrooms | 51699.236 | 13094.170 | 3.948 | 0.000 |

| living_area | 65.903 | 15.979 | 4.124 | 0.000 |

| lot_size | -0.897 | 4.194 | -0.214 | 0.831 |

| year_built | 3760.898 | 1962.504 | 1.916 | 0.059 |

| property_tax | 1.476 | 2.832 | 0.521 | 0.604 |

Model equation

\[ \begin{align}\hat{\text{price}} = & -7148818.957 - 12291.011 \times \text{bedrooms}\\[5pt] &+ 51699.236 \times \text{bathrooms} + 65.903 \times \text{living area}\\[5pt] &- 0.897 \times \text{lot size} + 3760.898 \times \text{year built}\\[5pt] &+ 1.476 \times \text{property tax} \end{align} \]

Interpreting \(\hat{\beta}_j\)

- The estimated coefficient \(\hat{\beta}_j\) is the expected change in the mean of \(y\) when \(x_j\) increases by one unit, holding the values of all other predictor variables constant.

- Example: The estimated coefficient for

living_areais 65.90. This means for each additional square foot of living area, we expect the sale price of a house in Levittown, NY to increase by $65.90, on average, holding all other predictor variables constant.

Application exercise

Prediction

What is the predicted sale price for a house in Levittown, NY with 3 bedrooms, 1 bathroom, 1,050 square feet of living area, 6,000 square foot lot size, built in 1948 with $6,306 in property taxes?

-7148818.957 - 12291.011 * 3 + 51699.236 * 1 +

65.903 * 1050 - 0.897 * 6000 + 3760.898 * 1948 +

1.476 * 6306[1] 265360.4The predicted sale price for a house in Levittown, NY with 3 bedrooms, 1 bathroom, 1050 square feet of living area, 6000 square foot lot size, built in 1948 with $6306 in property taxes is $265,360.

Prediction, revisit

Just like with simple linear regression, we can use the predict() function in R to calculate the appropriate intervals for our predicted values:

Confidence interval for \(\hat{\mu}_y\)

Calculate a 95% confidence interval for the estimated mean price of houses in Levittown, NY with 3 bedrooms, 1 bathroom, 1050 square feet of living area, 6000 square foot lot size, built in 1948 with $6306 in property taxes.

Prediction interval for \(\hat{y}\)

Calculate a 95% prediction interval for an individual house in Levittown, NY with 3 bedrooms, 1 bathroom, 1050 square feet of living area, 6000 square foot lot size, built in 1948 with $6306 in property taxes.

Cautions

- Do not extrapolate! Because there are multiple predictor variables, there is the potential to extrapolate in many directions

- The multiple regression model only shows association, not causality

- To show causality, you must have a carefully designed experiment or carefully account for confounding variables in an observational study

Recap

Introduced multiple linear regression

Interpreted a coefficient \(\hat{\beta}_j\)

Used the model to calculate predicted values and the corresponding intervals